Retirement is something that we all look forward to, but sometimes we are not sure where and how to begin. Understanding the different types of plans will be key to deciding the best option. Each retirement plan has different rules, contribution limits, and tax advantages. Below are important key facts about the 5 most common types of retirement plans.

1. A 401K plan is offered by for-profit companies and is typically available for full-time employees as a benefit. Most companies match the employee contribution, and employees simply contribute by dedicating a portion of their check directly to the retirement plan, which is managed by the employer.

a. Tax Advantages: Reduces taxable income, you will not pay taxes on the amount you have contributed for that year. The money grows tax-free until you withdraw it.

b. Contributions and limitations: In 2023, you can contribute up to $22,500 or $30,000 if you’re 50 years old or older. The total contribution combined from both employee and employer is $66,000, or $73,500 for those over 50 years old.

c. Unless, some exception applies, cannot withdraw funds prior to turning 59 ½ years old or older without penalty. Additionally, upon turning 72 you are required to take an annual distribution.

2. A Traditional IRA, an individual retirement account, is available to anyone with taxable income to open and manage for themselves.

a. Tax Advantages: Reduces taxable income, you will not pay taxes on the amount you have contributed for that year. The money grows tax-free until you withdraw it.

b. Contributions and limitations: For traditional accounts, the limitation is much smaller. In 2023, your max contribution is $6500 and $7,500 if you are 50 years old or older. That contribution limit is across all individual retirement accounts combined.

c. Unless, some exception applies, cannot withdraw funds prior to turning 59 ½ years old or older without penalty. Additionally, upon turning 72 years old you are required to take an annual distribution.

3. A Roth IRA is an individual retirement account that is available to almost anyone with taxable income to open and manage for themselves.

a. Tax advantages: You pay taxes on the money you contribute but can withdraw the money tax-free at retirement, allowing you to potentially pay less tax overall.

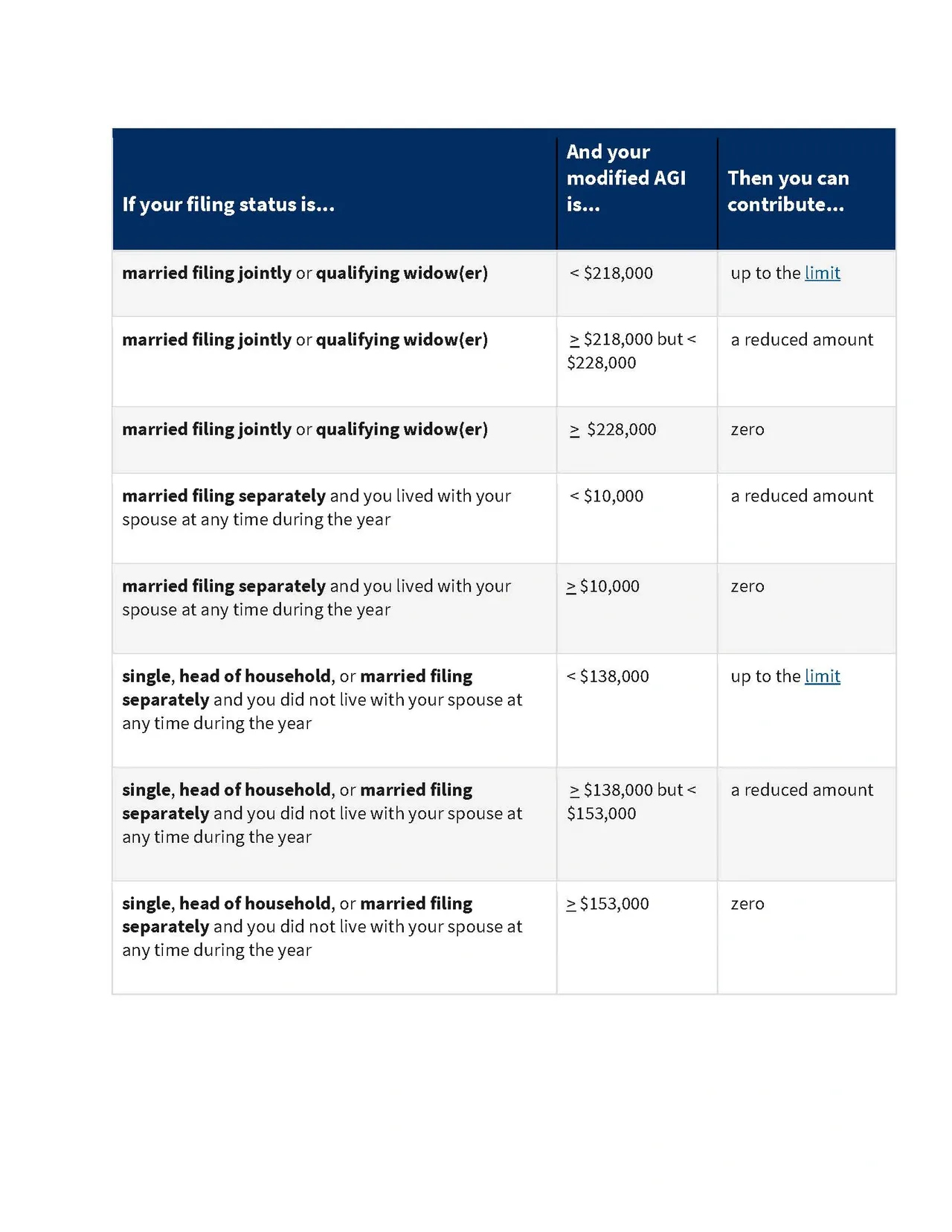

b. Contributions and limitations: For 2023, you can contribute $6500 and $7,500 if you are 50 years old or older. However, further limitations apply based on your income as displayed on the table.

c. Within some restrictions, you are allowed to withdraw money prior to turning 59 ½ years old and there are no required annual distributions once you are 72 years old.

Business Owners Options

1. The Simplified employee pension (SEP IRA) Plan is a form of retirement account used for self-employed individuals or small businesses. Similar to traditional IRA plans but allow much more contributions. In 2023, an employer can contribute up to 25% of the employee’s compensation, or $66,000. Therefore, if self-employed, you can contribute up to 25% of your net income.

2. A SIMPLE IRA, a form of retirement account used for small businesses with 100 or fewer employees. As an employee, you can receive contributions from your employer and those contributions are fully vested, meaning you can keep the employer’s contribution whenever you leave the company. For 2023, the amount an employee contributes from their salary to a SIMPLE IRA cannot exceed $15,500, and if 50 years or older an additional $3,500.00.

Overall, the various types of retirement plans differ based on each individual’s goal as it relates to income level, tax advantages, contributions, and limits. It is critical to consult a professional financial advisor and tax professional about your unique circumstances.